What are the two main financial institutions?

Types of financial institutions include: Banks. Credit unions.

The most common types of financial institutions include banks, credit unions, insurance companies, and investment companies. These entities offer various products and services for individual and commercial clients, such as deposits, loans, investments, and currency exchange.

Regional financial systems include banks and other institutions, such as securities exchanges and financial clearinghouses. The global financial system is basically a broader regional system that encompasses all financial institutions, borrowers, and lenders within the global economy.

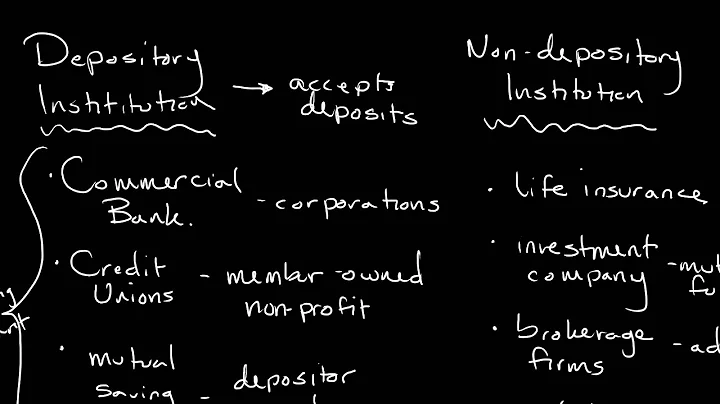

Financial institutions can be divided into two main groups: depository institutions and nondepository institutions. Depository institutions include commercial banks, thrift institutions, and credit unions. Nondepository institutions include insurance companies, pension funds, brokerage firms, and finance companies.

Retail banks offer loan and deposit services to the general public. Deposits are generally insured by the government up to a specified limit. Commercial banks provide services to corporations, with loan and deposit products tailored to these customers' needs.

Banks are the most common financial institution because they offer the most financial services. Checking accounts, savings accounts, home loans (mortgages), car loans, student loans, investment advice, ATMs, direct deposit and foreign currency swaps are just some of the many services banks offer.

A financial institution, sometimes called a banking institution, is a business entity that provides service as an intermediary for different types of financial monetary transactions.

| Rank by Asset Size | Bank Name | Total Assets |

|---|---|---|

| 1. | Chase Bank | $3.38 trillion |

| 2. | Bank of America | $2.45 trillion |

| 3. | Wells Fargo | $1.7 trillion |

| 4. | Citibank | $1.68 trillion |

Retail banks, also known as consumer banks, are commercial banks that offer consumer and personal banking services to the general public. Most retail banks offer checking accounts, savings accounts and retirement accounts.

Firstly, the investment decision entails determining assets that the firm needs or projects it needs. Under this function, the finance manager makes capital investment decisions and working capital management decisions. Secondly, the financing decision function entails finding sources of funds to finance investments.

What are the two main functions of finance?

- to provide the financial information that other business functions require to operate effectively and efficiently.

- to support business planning and decision-making.

Whenever you borrow money, you are required to pay that base amount (the principal) back to your lender. In addition, you will be required to pay your lender the interest, which is typically an annual percentage of the principal, set for the loan.

Each has some special features: Banks emphasize business and consumer accounts, and many provide trust services. Credit unions emphasize consumer deposit and loan services. Savings institutions emphasize real estate financing.

- Mutual Fund. ...

- Insurance Company. ...

- Provident Fund. ...

- Credit card and Personal loan Company. ...

- Asset Management Company. ...

- Securities Company.

Public sector Banks – A bank where the majority stakes are owned by the Government or the central bank of the country. Private sector Banks – A bank where the majority stakes are owned by a private organization or an individual or a group of people.

Banks make their money in a variety of ways, but most can be classified as either fees or interest income. Let's take a look at fees first. There are many different types of fees banks can collect, both on the commercial banking and investment banking sides of the business.

The four basic types are checking account, savings account, certificate of deposit and money market account. Each kind of account serves a different purpose. For instance, a checking account is geared toward covering everyday expenses, while a savings account is designed to help achieve short-term financial goals.

| Ranking | Bank | LEARN MORE |

|---|---|---|

| 1 | JPMorgan Chase | Learn More |

| 2 | Bank of America | Learn More |

| 3 | Wells Fargo | Learn More |

| 4 | Citibank | Learn More |

Credit unions tend to offer lower rates and fees as well as more personalized customer service. However, banks may offer more variety in loans and other financial products and may have larger networks that can make banking more convenient.

Retail and Commercial Banks

Retail and commercial banks are the banks that consumers mostly interact with. Retail banks offer products to individual consumers and commercial banks offer products to businesses. The majority of retail/commercial banks offer deposit accounts, lending, and some financial advice.

Which savings account will earn you the most money?

A money market account (MMA) is a savings account that typically pays higher interest rates than regular savings accounts. MMAs usually offer tiered rates, meaning you can earn an even higher rate on large balances or on part of your balance over a certain level.

Checking account: A checking account offers easy access to your money for your daily transactional needs and helps keep your cash secure. Customers can typically use a debit card or checks to make purchases or pay bills.

Credit Companies often win in a credit transaction, due to their clients continually pay them for their usage. g. How does risk influence the rate of interest? Higher-risk loans-- loans where it is uncertain that the borrower can repay--usually result in higher interest rates.

Commercial banks make money by providing and earning interest from loans such as mortgages, auto loans, business loans, and personal loans. Customer deposits provide banks with the capital to make these loans.

The non-banking financial institution which comes under the category of financial institutions cannot accept deposits into savings and demand deposit accounts. A bank is a financial institution which can accept deposits into various savings and demand deposit accounts, and give out loans.

References

- https://www.nerdwallet.com/best/banking/checking-accounts

- https://www.investopedia.com/terms/b/bank-statement.asp

- https://finance.yahoo.com/news/4-most-popular-banks-millionaires-150054420.html

- https://www.moneyhelper.org.uk/en/savings/investing/peer-to-peer-lending-what-you-need-to-know

- https://www.thebalancemoney.com/what-is-a-financial-institution-5190896

- https://kids.britannica.com/students/article/bank-and-banking/273096

- https://www.usnews.com/banking/articles/what-types-of-bank-accounts-are-there

- https://newsroom.bankofamerica.com/content/newsroom/company-overview.html

- https://www.creditninja.com/blog/where-do-banks-get-money-to-lend-to-borrowers/

- https://www.investopedia.com/terms/a/accountingmethod.asp

- https://mycreditunion.gov/about-credit-unions

- https://www.bill.com/learning/types-of-financial-institutions

- https://www.bartleby.com/questions-and-answers/an-important-financial-institution-that-assists-in-the-initial-sale-of-securities-in-the-primary-mar/7f6e7833-fe8c-41e0-bfca-fb1b1bd1a3c3

- https://www.fdic.gov/resources/resolutions/bank-failures/failed-bank-list/

- https://www.wellsfargo.com/financial-education/basic-finances/manage-money/options/bank-account-types/

- https://localfirstbank.com/article/financial-institution-definition-and-what-to-look-for/

- https://www.bankrate.com/banking/digital-banking-trends-and-statistics/

- https://www.bot.or.th/en/our-roles/financial-institutions/Thailand-financial-institutions-and-financial-service-providers/non-depository-corporations.html

- https://www.nerdwallet.com/article/banking/is-my-money-safe-in-a-bank

- https://dfi.wi.gov/Pages/ConsumerServices/WisconsinConsumerAct/DifferencesBanksCreditUnionsSavingsInstitutions.aspx

- https://www.contractscounsel.com/t/us/basic-transaction

- https://byjus.com/free-ias-prep/types-banks-india/

- https://byjus.com/ias-questions/what-is-the-difference-between-a-financial-institution-and-bank/

- https://www.studysmarter.co.uk/explanations/macroeconomics/financial-sector/banking/

- https://www.investopedia.com/terms/c/commercialbank.asp

- https://homework.study.com/explanation/what-are-the-three-major-functions-of-the-financial-manager-how-are-they-related.html

- https://brainly.com/question/30457480

- https://www.cnbc.com/select/how-to-avoid-common-checking-account-fees/

- https://www.investopedia.com/ask/answers/030415/what-distinguishes-financial-services-sector-banks.asp

- https://www.tibco.com/reference-center/what-is-transactional-data

- https://www.pbs.org/newshour/economy/your-financial-accounts-are-safe-experts-say-heres-what-protects-them

- https://courses.lumenlearning.com/suny-osintrobus/chapter/u-s-financial-institutions/

- https://unacademy.com/content/kerala-psc/study-material/science-technology/banking-and-non-banking-financial-institutions/

- https://www.silamoney.com/ach/understanding-the-9-major-types-of-financial-institutions

- https://homework.study.com/explanation/the-two-broadest-groups-of-financial-institutions-in-the-u-s-can-be-classified-as-a-financial-intermediaries-and-securities-firms-b-depository-and-non-depository-intermediaries-c-commercial-banks-and-thrift-institutions-d-money-market-firms-and-capi.html

- https://www.freeagent.com/glossary/bank-transaction/

- https://www.atlantis-press.com/article/125965909.pdf

- https://www.worldbank.org/en/publication/gfdr/gfdr-2016/background/financial-development

- https://www.forbes.com/advisor/banking/us-bank-review/

- https://www.creditkarma.com/money/i/types-of-banks

- https://www.bankoflabor.com/four-cs-of-credit/

- https://www.imf.org/external/pubs/ft/fandd/basics/finserv.htm

- https://www.nationalmerchants.com/defining-transaction-type-how-many-different-kinds-are-there/

- https://www.fool.com/investing/stock-market/market-sectors/financials/bank-stocks/how-banks-make-money/

- https://www.bondrees.com/can-money-be-taken-from-your-bank-account-without-permission/

- https://www.tx.cpa/docs/default-source/communications/2020-today's-cpa/january-february/tech-issues-using-recurring-transactions-in-quickbooks-jan-feb-2020-today's-cpa.pdf?sfvrsn=fc4c3b1_2

- https://web.ntpu.edu.tw/~hlchih/data/Financial%20Intitutions%20Management/Financial%20Institutions%20Management_Solutions_Chap001.doc

- https://portal.ct.gov/DOB/Consumer/Consumer-Education/ABCs-of-Banking---Banks-and-Our-Economy

- https://www.bankrate.com/banking/what-banks-do-with-deposits/

- https://www.marketwatch.com/guides/banking/largest-banks-in-the-us/

- https://www.investopedia.com/ask/answers/041615/what-difference-between-fiat-money-and-representative-money.asp

- https://www.investopedia.com/ask/answers/061615/what-are-major-categories-financial-institutions-and-what-are-their-primary-roles.asp

- https://secny.org/difference-between-credit-union-and-bank/

- https://portal.ct.gov/DOB/Consumer/Consumer-Education/ABCs-of-Banking--Banks-Thrifts-and-Credit-Unions

- https://tiger-recruitment.com/job-seekers/pros-cons-career-financial-services/

- https://en.wikipedia.org/wiki/Financial_institution

- https://www.mx.com/guides/trust-and-the-consumer-money-experience/

- https://www.investopedia.com/terms/o/onlinebanking.asp

- https://www.energy.gov/scep/slsc/financial-institutions

- https://www.jagranjosh.com/general-knowledge/list-of-largest-banks-in-the-world-1706509334-1

- https://www.raisin.com/en-us/save-with-purpose/not-for-profit

- https://www.wellsfargo.com/com/industry/financial-institutions/

- https://www.jagranjosh.com/general-knowledge/what-is-a-bank-statement-what-are-the-types-and-purpose-of-bank-statement-1660116051-1

- https://www.worldbank.org/en/publication/gfdr/gfdr-2016/background/nonbank-financial-institution

- https://www.investopedia.com/credit-unions-vs-banks-4590218

- https://www.jpmorganchase.com/about/our-history

- https://www.investopedia.com/terms/f/financialinstitution.asp

- https://en.wikipedia.org/wiki/List_of_largest_banks_in_the_United_States

- https://gocardless.com/en-us/guides/posts/types-of-financial-statements/

- https://www.wallstreetmojo.com/financial-transaction/

- https://www.capitalone.com/bank/disclosures/online-banking/faqs/

- https://www.investopedia.com/ask/answers/030315/what-financial-services-sector.asp

- https://byjus.com/ias-questions/what-are-the-5-most-important-banking-services/

- https://quizlet.com/181652630/finances-financial-institutions-flash-cards/

- https://www.imf.org/external/pubs/ft/fandd/2011/03/basics.htm

- https://corporatefinanceinstitute.com/resources/accounting/sources-of-funding/

- https://www.investopedia.com/terms/r/riskreturntradeoff.asp

- https://www.fdic.gov/resources/resolutions/resolution-authority/resplans/plans/pnc-idi-1807.pdf

- https://www.oneazcu.com/about/financial-resources/saving-budgeting/which-savings-account-will-earn-you-the-most-money/

- https://www.docuclipper.com/blog/bank-transactions/

- https://www.thehindubusinessline.com/money-and-banking/The-seven-lsquoPs-essential-for-marketing-of-bank-services/article20310257.ece

- https://www.investopedia.com/articles/pf/11/benefits-and-drawbacks-of-internet-banks.asp

- https://brainly.com/question/41533732

- https://www.forbes.com/advisor/banking/largest-banks-in-the-us/

- https://brainly.com/question/14450780

- https://www.bbc.co.uk/bitesize/guides/zk94cqt/revision/1

- https://brainly.com/question/42266243

- https://kannepersonalfinance1914.weebly.com/32-spending--credit.html

- https://www.bankrate.com/banking/biggest-banks-in-america/

- https://www.investopedia.com/terms/f/financial-system.asp

- https://en.wikipedia.org/wiki/Money_creation

- https://www.bankrate.com/banking/savings/what-is-interest/

- https://imarticus.org/blog/why-are-banks-called-financial-institutions-significant-differences-between-banks-and-financial-institutions/

- https://www.law.cornell.edu/uscode/text/15/6827

- https://www.gpb.org/education/econ-express/financial-institutions

- https://www.shiksha.com/online-courses/articles/financial-institutions-types-roles-and-advantages/

- https://localfirstbank.com/article/four-different-types-of-services-banking/

- https://fyi.extension.wisc.edu/moneymatters/credit-unions-banks-and-other-financial-institutions/

- https://switcher.ie/current-accounts/

- https://www.imf.org/en/Publications/fandd/issues/Series/Back-to-Basics/Banks

- https://www3.mtb.com/personal-banking/checking/understanding-checking-account-transactions

- https://www.bankbound.com/blog/marketing-increase-deposits/

- https://www.investopedia.com/terms/f/financialintermediary.asp

- https://scripbox.com/pf/my-account-balance/

- https://www.iggsoft.com/ibank/iBank_5_Help/transactions/types.html

- https://time.com/personal-finance/article/how-much-cash-to-keep-in-checking-account/

- https://www.fe.training/free-resources/fig/different-types-of-banks/

- https://www.shopify.com/blog/payment-options

- https://brainly.com/question/37278337

- https://www.nucoro.com/insights/how-banks-make-money-and-why-its-shifting-in-2021

- https://www.khanacademy.org/college-careers-more/financial-literacy/xa6995ea67a8e9fdd:investments-retirement/xa6995ea67a8e9fdd:saving-and-investing/a/financial-institutions-and-markets

- https://www.investopedia.com/terms/n/non-member-banks.asp

- https://www.investopedia.com/ask/answers/032515/what-are-examples-popular-companies-financial-services-sector.asp