Do digital payment services require a bank account or debit card to make transactions?

This means that for digital payments to take place, the payer and payee both must have a bank account, an online banking method, a device from which they can make the payment, and a medium of transmission, meaning that either they should have signed up to a payment provider or an intermediary such as a bank or a ...

These alternate methods of online payment include third-party payment services (such as Paypal, Amazon Pay, Google Pay, or Apple Pay), bank transfers, electronic checks, and electronic bill payment.

Sometimes referred to as electronic payments, digital payments are financial transactions that do not involve the physical transfer of currency. Instead of paper, you're trading 1s and 0s, and this is true whether you're paying online via a mobile wallet or in person using your credit and debit card.

Essentially, your customer provides their credit card details, typically by filling out an online payment form that requests the name on the card, the card type, the card number, the CVV, the expiry date, and the cardholder's address.

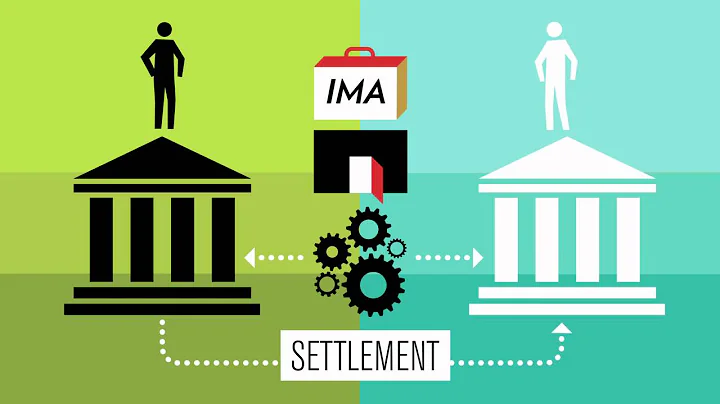

A digital payment, sometimes called an electronic payment, is the transfer of value from one payment account to another using a digital device or channel. This definition may include payments made with bank transfers, mobile money, QR codes, and payment instruments such as credit, debit, and prepaid cards.

Online payment services

PayPal, Venmo, Western Union, and Cash App are some of the most popular payment services that do not require you to own a bank account to receive money. If you use a payment app like PayPal, Venmo, or Cash App, your recipient may sign up for the app and link a prepaid debit card.

With this feature, you can withdraw money from an ATM with your Google Pay app without the use of your debit card. When you select the option “UPI Cash withdrawal” and an amount on an ATM, you can do a normal UPI transaction through a QR scan payment on Google Pay.

We asked U.S. consumers about "Most used online payments by brand" and found that "PayPal" takes the top spot, while "Skrill" is at the other end of the ranking. Find this and more survey data on most used online payments by brand in our Consumer Insights tool.

- Banking Cards.

- USSD (Unstructured Supplementary Service Data)

- UPI (United Payment Interface)

- AEPS (Aadhaar enabled Payment System)

- Mobile wallets.

- Point of Sale Machines (PoS)

- Mobile Banking.

- Internet Banking.

The term direct deposit refers to the deposit of funds electronically into a bank account rather than through a physical, paper check. Direct deposit requires the use of an electronic network that allows deposits to take place between banks.

Do you need a credit card for online payments?

If merchants can take payment by credit card, they can also take payment by debit card. If you're uncomfortable using your regular debit card on the internet, you can use a prepaid debit card. Some of these are use-once cards (such as gift cards). Many, however, can be reloaded for continual use.

Bank Transfers: Online merchants often accept bank transfers, initiated through online banking or mobile banking apps. Mobile Payment Apps: Apps like Venmo, Cash App, or Samsung Pay enable online payments without an ATM card by linking your bank account or adding funds to a digital wallet within the app.

You can buy things online without a credit card using a debit card, prepaid card, gift card, mobile payment app, and even cryptocurrency.

Digital banking is more of an overarching term which refers to all forms of financial transactions taking place with the aid of technology. Therefore, it could be argued that online banking is a form of digital banking, but that digital banking is much more than just online banking.

A bank transfer is another form of electronic payment that sends money directly from one bank account to another. ACH (Automatic Clearing House) transfers are one of the most recognized and widely used forms of domestic bank transfers.

EFTs usually process funds via an automated clearing house (ACH) while wire transfers are sent directly between one bank and another. Wire transfers have the benefit of being faster and having higher transfer limits than EFT methods, but they carry higher fees and are not reversible.

Paytm: Paytm started as a digital wallet and has expanded to offer UPI services. It provides various features like mobile recharges, bill payments, online shopping, and more. OmniCard: With OmniCard, Instantly generate UPI ID and conduct effortless payment transactions without linking a Bank A/c.

PayPal allows you to make payments using a variety of methods including: PayPal balance, a bank account, PayPal Credit, debit or credit cards, and rewards balance.

Do You Need a Bank Account for PayPal? No, you don't need a bank account to sign up for PayPal or to receive payments. You can, however, connect your PayPal account to a bank account, a debit card or a credit card account for sending and receiving payments and transferring funds.

Mobile wallets offer a useful way for people without bank accounts to send and receive money. There are lots to choose from, with some of the most well-known being Apple Pay, Google Pay and Samsung Pay. It's a kind of digital wallet where card information is stored on an app on your phone.

How can I do a transaction without a bank account?

Digital Wallets: Some digital wallet services allow you to make online payments without a traditional bank account. You can load funds into these digital wallets using cash at retail locations, via mobile recharge shops, or through other payment methods. Popular digital wallets include PayPal, Google Pay, and PayTM.

no, it is not compulsory. You can handle/use the bank account without having the debit card.

- PayPal. Safe and secure.

- Credit card. Well protected against fraudulent transactions.

- Debit card. Great for controlling your spending.

- Prepaid card. Provides a certain level of privacy.

- Digital wallets. ...

- Mobile payment apps. ...

- Cryptocurrencies.

- Virtual credit cards. ...

- Digital wallets. ...

- Prepaid cards. ...

- ACH payments. ...

- Cryptocurrency.

Digital payments are transactions that take place via digital or online modes, with no physical exchange of money involved. This means that both parties, the payer and the payee, use electronic mediums to exchange money.

References

- https://help.venmo.com/hc/en-us/articles/360027356113-Identity-Verification

- https://www.gobankingrates.com/banking/checking-account/can-you-purchase-online-directly-from-checking-account/

- https://www.icicibank.com/blogs/credit-card/how-to-get-a-credit-card-without-bank-account

- https://wise.com/us/blog/is-venmo-safe

- https://staxpayments.com/blog/electronic-transfer-vs-wire-transfer/

- https://www.visa.ca/en_CA/pay-with-visa/cards/debit-cards.html

- https://www.uzio.com/resources/how-do-you-pay-employees-who-do-not-have-a-bank-account/

- https://www.paypal.com/us/money-hub/article/instant-money-transfer

- https://rates.fm/payment-systems/venmo-review-pros-and-cons-of-choosing-this-payment-app/

- https://time.com/personal-finance/article/venmo-guide/

- https://www.paycec.com/faq/how-to-do-online-payment-without-an-atm-card

- https://www.quora.com/Is-it-compulsory-for-the-users-to-take-Debit-card-along-with-the-bank-account

- https://www.podium.com/article/paypal-personal-vs-business-account/

- https://wise.com/us/blog/send-money-with-debit-card

- https://www.linkedin.com/pulse/how-buy-gift-cards-online-checking-account-aquilaresources-wfmqe?trk=public_post_main-feed-card_feed-article-content

- https://gocardless.com/en-us/guides/posts/what-are-digital-payments/

- https://omnicard.in/blogs/upi-app-in-india-200923

- https://smallbusiness.chron.com/request-hold-removal-paypal-54784.html

- https://www.paypal.com/sg/cshelp/article/how-do-i-withdraw-funds-from-my-paypal-account-help394

- https://cash.app/send

- https://swissmoney.com/how-to-transfer-money-from-a-bank-account-to-the-cash-app-instantly/

- https://www.lloydsbank.com/credit-cards/help-and-guidance/credit-vs-debit-cards.html

- https://tipalti.com/payments-hub/paypal-fees/

- https://razorpay.com/learn/digital-payments-india-definition-methods-importance/

- https://wallethub.com/edu/cc/how-to-buy-things-online-without-a-credit-card/25549

- https://support.google.com/pay/india/answer/14010375?hl=en

- https://www.chase.com/personal/credit-cards/education/basics/how-to-find-credit-card-account-number

- https://www.paypal.com/ie/cshelp/article/how-do-i-withdraw-money-to-my-bank-account-help394

- https://smartasset.com/checking-account/how-to-send-money-to-someone-without-a-bank-account

- https://www.linkedin.com/pulse/instant-transfer-routing-account-number-without-guide-tebid-kelly

- https://www.linkedin.com/pulse/easy-guide-instant-transfer-routing-account-number-without

- https://www.linkedin.com/pulse/how-do-i-enable-instant-deposit-cash-app-efang-brandon-suj6e

- https://www.usnews.com/banking/articles/how-to-transfer-money-from-one-bank-to-another

- https://usa.visa.com/support/consumer/debit-cards.html

- https://www.investopedia.com/articles/personal-finance/050214/credit-vs-debit-cards-which-better.asp

- https://www.cardrates.com/advice/prepaid-debit-cards-without-bank-account-requirements/

- https://www.quora.com/Can-Visa-Mastercard-debit-cards-be-used-for-all-transactions-that-require-a-credit-card

- https://www.paypal.com/us/brc/article/what-is-a-business-account

- https://support.2go.com/hc/en-us/articles/236226847-When-Will-My-PayPal-Transfer-Be-Available-in-My-Bank-Account

- https://www.security.org/digital-safety/is-venmo-safe/

- https://www.xoom.com/united-states

- https://www.linkedin.com/pulse/how-get-money-from-venmo-without-bank-account-itgust

- https://lili.co/blog/paypal-fees-for-receiving-money

- https://www.mastercard.us/en-us/personal/find-a-card/general-prepaid-mastercard.html

- https://synder.com/blog/how-much-does-a-seller-fee-get-charged-a-really-short-paypal-fees-overview/

- https://byjus.com/commerce/types-of-digital-payments/

- https://zipbooks.com/blog/paypal-vs-venmo-vs-zelle/

- https://www.betterthancash.org/define-digital-payments

- https://rates.fm/how-to-create-a-paypal-account-to-accept-online-payments/

- https://www.paypal.com/us/cshelp/article/how-long-does-it-take-to-add-money-from-my-bank-help128

- https://wise.com/us/blog/how-to-send-money-to-someone-without-a-bank-account

- https://www.bankfive.com/blogs/november-2023/5-tips-for-protecting-your-bank-account-information

- https://www.reddit.com/r/paypal/comments/124k2j5/can_i_receive_money_without_a_bank_account/

- https://www.hiveage.com/blog/paypal-fees-guide/

- https://www.wikihow.com/Transfer-Money-from-PayPal-to-Cash-App

- https://www.visa.com.au/pay-with-visa/find-a-card/debit-cards.html

- https://www.paypal.com/us/cshelp/article/how-can-i-release-my-payments-on-hold-help129

- https://www.paypal.com/us/cshelp/article/what-is-the-difference-between-personal-and-business-accounts%E2%80%AF-help318

- https://www.businessinsider.com/personal-finance/how-to-send-money-to-someone-without-a-bank-account

- https://www.hdfcbank.com/personal/resources/learning-centre/pay/how-to-transfer-money-from-one-bank-account-to-another

- https://www.forbes.com/advisor/business/paypal-vs-venmo/

- https://www.linkedin.com/pulse/can-i-receive-money-paypal-without-linking-bank-account-brian-senk-vvygf

- https://www.linkedin.com/pulse/can-you-have-two-venmo-accounts-tebid-kelly

- https://www.chase.com/personal/credit-cards/education/basics/do-i-need-a-credit-card-for-paypal

- https://wise.com/us/blog/send-money-routing-account-number

- https://www.paypal.com/us/webapps/mpp/popup/about-payment-methods

- https://help.venmo.com/hc/en-us/articles/235399967-Standard-Bank-Transfers-FAQ

- https://suitsmecard.com/blog/what-are-the-main-differences-between-digital-banking-and-online-banking

- https://venmo.com/legal/us-helpful-information/

- https://help.venmo.com/hc/en-us/articles/217042698-Joint-Bank-Accounts

- https://www.wellsfargo.com/financial-education/basic-finances/manage-money/payments/ins-outs-transfers/

- https://www.freshbooks.com/hub/payments/paypal-limits

- https://gocardless.com/guides/posts/how-to-pay-online-without-a-credit-card/

- https://www.paypal.com/us/cshelp/article/paypal-error-messages-when-trying-to-transfer-money-help408

- https://finance.yahoo.com/personal-finance/venmo-tax-184912719.html

- https://www.bankrate.com/banking/how-to-transfer-money-from-one-bank-to-another/

- https://wallethub.com/answers/cc/credit-card-for-no-credit-and-no-bank-account-2140655109/

- https://lili.co/resources/accounting/paypal-fee-calculator

- https://usa.visa.com/pay-with-visa/cards/prepaid-cards/all-purpose-reloadable.html

- https://www.linkedin.com/pulse/how-transfer-money-from-bank-account-cash-app-sebastien-onutali-rlime

- https://www.paypal.com/us/cshelp/article/what-debit-or-credit-cards-can-i-use-with-paypal-help612

- https://www.investopedia.com/terms/d/directdeposit.asp

- https://www.paypal.com/sr/webapps/mpp/security/accessing-funds-problem

- https://www.linkedin.com/pulse/how-transfer-money-from-paypal-cash-app-3-best-method-itgust

- https://www.paypal.com/us/cshelp/article/where%E2%80%99s-my-withdrawal-help456

- https://www.nerdwallet.com/article/banking/prepaid-debit-cards-what-you-should-know

- https://www.statista.com/forecasts/997132/most-used-online-payments-by-brand-in-the-us

- https://www.checkout.com/blog/safe-payment-methods

- https://www.paypal.com/us/cshelp/article/why-haven%E2%80%99t-i-received-my-paypal-debit-card-help500

- https://cadencebank.com/insights-and-articles/personal/difference-between-debit-and-credit-cards

- https://help.venmo.com/hc/en-us/articles/210413477-Sending-Requesting-Money

- https://statrys.com/blog/paypal-business-vs-personal

- https://nordvpn.com/blog/safest-way-to-pay-online/

- https://www.linkedin.com/pulse/how-send-money-cash-app-without-debit-card-3-simple-steps-brandon

- https://www.aura.com/learn/i-got-scammed-on-venmo-what-do-i-do

- https://www.nerdwallet.com/article/credit-cards/what-is-plaid-and-how-does-it-work

- https://paymentdepot.com/blog/how-do-you-avoid-paypal-fees/

- https://www.forbes.com/advisor/banking/best-prepaid-debit-cards/

- https://www.paypal.com/us/cshelp/article/how-do-i-link-a-bank-account-to-my-paypal-account-help183

- https://help.venmo.com/hc/en-us/articles/209690058-Adding-a-Bank-Account

- https://www.bankrate.com/banking/reasons-to-be-unbanked-or-underbanked/

- https://www.businessinsider.com/guides/tech/does-venmo-accept-prepaid-cards

- https://synder.com/blog/paypal-verification-what-you-should-know-to-keep-your-account-safe/

- https://wise.com/gb/blog/can-i-have-more-than-one-paypal-account

- https://www.fdic.gov/getbanked/pdf/top-reasons-to-open-a-bank-account.pdf

- https://www.forbes.com/advisor/banking/paypal-as-bank-account/

- https://www.fool.com/the-ascent/banks/articles/heres-what-happens-when-you-dont-have-a-bank-account/

- https://consumer.gov/managing-your-money/prepaid-cards

- https://wallethub.com/answers/ca/prepaid-card-declined-2140811690/

- https://www.fdic.gov/analysis/household-survey/index.html

- https://www.linkedin.com/pulse/venmo-identity-verification-step-by-step-guide-tebid-kelly-hvwae

- https://www.quora.com/Why-can-t-I-receive-money-by-my-PayPal-account-When-trying-to-transfer-money-to-it-it-says-your-recipient-cannot-accept-payments-right-now

- https://wallethub.com/answers/cc/credit-card-no-bank-account-2140672490/

- https://help.venmo.com/hc/en-us/articles/235224088-Bank-Accounts-Cards-FAQ

- https://www.experian.com/blogs/ask-experian/how-to-withdraw-money-from-checking-account-without-debit-card/

- https://www.quora.com/How-can-I-make-an-online-payment-without-a-bank-account

- https://www.linkedin.com/pulse/cash-app-instant-deposit-showing-up-causes-solutions-tebid-kelly-kvmmc

- https://www.investopedia.com/financial-edge/1111/alternate-methods-of-online-payment.aspx

- https://www.transfergo.com/send-money-debit-credit-card

- https://www.aura.com/learn/what-can-someone-do-with-your-bank-account-number

- https://www.fastcompany.com/91014699/our-world-isnt-designed-for-the-growing-number-of-unbanked-people

- https://www.linkedin.com/pulse/how-send-money-cash-app-without-tebid-kelly

- https://money.com/what-is-venmo-how-it-works/

- https://www.quora.com/What-happens-if-you-dont-have-a-bank-account

- https://cash.app/help/us/en-us/1105-sending-a-payment

- https://wise.com/us/blog/paypal-business-vs-personal

- https://www.paypal.com/au/cshelp/article/what-payment-methods-can-i-use-with-paypal-help468

- https://www.paypal.com/us/digital-wallet/send-receive-money/request-money

- https://www.gobankingrates.com/banking/mobile/can-i-have-two-venmo-accounts/

- https://www.paypal.com/ng/cshelp/article/how-do-i-send-money-help293

- https://www.linkedin.com/pulse/can-i-use-cash-app-transfer-money-myself-efang-brandon-dl8pe

- https://www.verifi.com/chargebacks-disputes-faq/how-do-online-payments-work/

- https://www.westernunion.com/blog/en/wire-transfer-vs-bank-transfer-whats-the-difference/

- https://www.paypal.com/c2/webapps/mpp/how-to-guides/link-credit-debit-card?locale.x=en_C2

- https://www.legalzoom.com/articles/should-i-have-a-paypal-business-account

- https://www.paypal.com/us/cshelp/article/how-do-i-get-money-out-of-my-paypal-account-help394

- https://time.com/personal-finance/article/best-money-transfer-payment-apps/

- https://www.linkedin.com/pulse/swipeonidea-instant-bank-transfer-without-debit-card-olivia-rosa-7c15c

- https://www.paypal.com/us/cshelp/article/what-is-the-paypal-debit-card-and-how-do-i-get-one-help669

- https://www.usnews.com/banking/articles/best-ways-to-quickly-transfer-money